Overview

In the ever-evolving landscape of digital finance, CRED has emerged as a trailblazing solution for credit card users in India. By addressing the challenge of credit card debt management and promoting financial responsibility, CRED has positioned itself as a platform that rewards individuals for their prudent financial habits. Let’s dive into a comprehensive breakdown of CRED’s journey, its offerings, what sets it apart, and the potential areas for improvement.

Analysis

CRED’s Purpose and Vision

CRED’s inception stems from the desire to alleviate the burden of credit card debt and streamline the management of multiple credit cards. This vision has evolved into a community of high-trust individuals who are celebrated for their financial responsibility. CRED doesn’t just facilitate bill payments; it fosters financial awareness, educates users, and cultivates a sense of trust through exclusive benefits.

Features That Empower

CRED stands as a versatile platform that extends beyond credit card payments. Its encompassing feature set includes managing credit card bills, recurring bills, UPI payments, rent payments, P2P lending, and short-term cash loans. The introduction of lifestyle rewards, curated travel packages, and engaging gamification elevate user engagement to new heights.

Revenue Model and Data Monetization

CRED’s ingenious revenue model encompasses data monetization, transaction commissions, and listing fees. The platform harnesses user data to provide insights to financial instrument vendors. Meanwhile, transaction charges and commissions from loans, bills, and rent payments contribute to the revenue stream. Listing fees from brands listed on the CRED store and travel portal further solidifies its financial standing.

Unveiling Data Insights

CRED’s user growth has been remarkable, with its member community expanding exponentially. Revenue from operations has surged, even though losses have widened. This signifies a strong engagement rate, with users consistently redeeming rewards. The credit card industry in India is booming, with a significant uptick in both users and transactions.

What Could Be Better

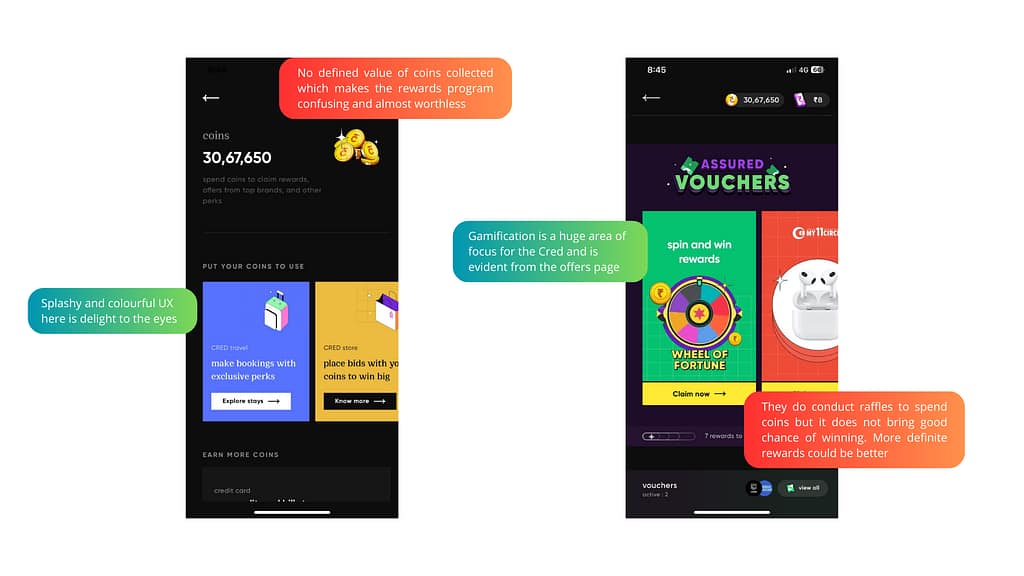

Refining User Experience

While CRED’s interface is enticing, there’s room for enhancement. The lack of a notification centre could be a conscious decision to maximize user time on the app. However, it might be beneficial to explore integrating key notifications for a more user-friendly experience. Additionally, consolidating certain sections, like UPI payments, into a single screen, could streamline user interaction.

Optimizing Functionality

CRED Cash’s usage frequency might be limited. A reimagining of this feature as a means to display due bills and facilitate immediate payments could enhance its utility. Moreover, CRED could leverage available data to automatically fetch bill details and offer automatic payment options.

Enhancing Rewards Program

CRED’s Neumorphism-inspired design language, coupled with the Re. 1 = 1 Cred Coin strategy, has successfully driven user engagement. However, refining the rewards program to allow users to settle credit card bills or other bills directly using their reward points could provide more tangible benefits. Diversifying coin usage options, similar to how CheQ operates, might also amplify user engagement.

Expanding Product Offering

While CRED’s store thrives on its curated content, integrating a search bar could significantly enhance user experience. It could lead to more targeted browsing and encourage impulsive shopping. Additionally, introducing curated boxes based on themes could cater to users seeking a holistic lifestyle experience.

Recommendations

Empowering Financial Goals

CRED could introduce goal-based tracking, allowing users to set spending targets for various categories. By leveraging AI, the app could then offer tailored expense and investment recommendations. This would aid users in making informed financial decisions and planning for the future.

Inclusivity in Target Audience

Rather than limiting access based solely on credit score thresholds, CRED could diversify its user levels. Segmenting users based on different credit score ranges would open the platform to a broader audience, fostering inclusivity while accommodating users with varying financial backgrounds.

Integrated Banking Ecosystem

Expanding beyond payments, CRED could venture into integrated banking services. By offering score-based lifestyle services, investing recommendations, and potentially even a paid family subscription model, CRED could enhance its revenue streams while providing comprehensive financial solutions.

Conclusion/Takeaways

CRED’s journey is a testament to its commitment to transforming credit card management into a rewarding and educational experience. By fostering financial responsibility, designing an exceptional user experience, and building a high-trust community, CRED has carved a unique niche in the fintech landscape. As the fintech industry continues to flourish, CRED’s dedication to user empowerment and financial awareness stands as an exemplary model for others to follow.

In the grand scheme of India’s financial evolution, CRED is a driving force propelling individuals toward financial excellence, one responsible payment at a time.

You can find the complete slide deck here: